Scaling Forest Finance with ITMOs

The Case for Using ITMOs to Scale Forest Finance & Meet the Paris Agreement & Biodiversity Global Goals

October 28, 2024 – ITMO Ltd. > Research > Insights > Download the report >>

By Michael Mathres

Chief Marketing Officer, ITMO Ltd

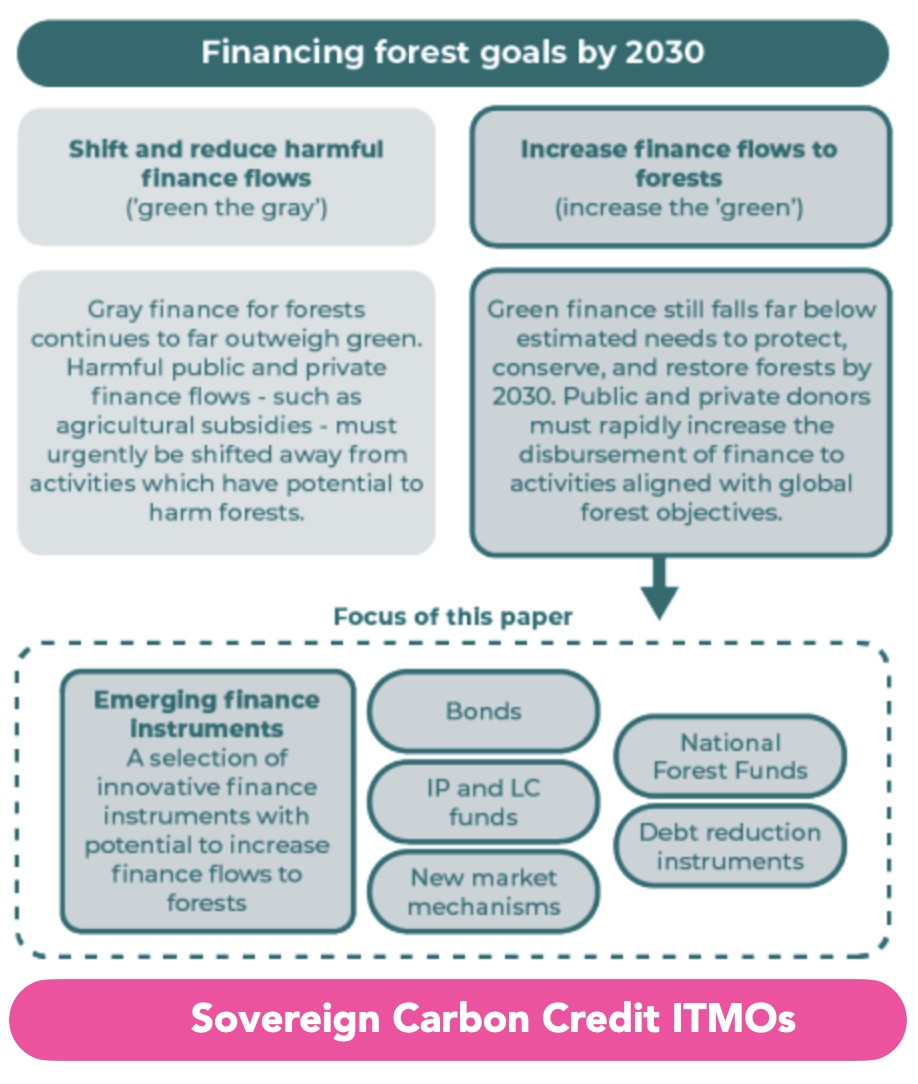

In September 2024, Forest Declaration Assessment wrote a report entitled Emerging Forest Finance Instruments exploring all the various finance forest mechanisms that can be used by investors and governments. Unfortunately they did not include ITMOs, probably because the world’s first ITMOs was publicly launched in August 2024.(1) This insight report aims to explain how ITMOs fit all these Emerging Forest Finance instruments and why it probably is the most scalable, innovative and inclusive financial mechanism as it solves all the challenges addressed by the Forest Declaration Assessment, while meeting the UNFCCC Paris Agreement and the UN Biodiversity goals.(2)(3) Download the report >>

Forest Finance & ITMOs

The planet’s health and ecosystem are highly dependent on forests as they mitigate and sequester carbon, regulate our climate, protect biodiversity, and support livelihoods. These ecological services provide a wealth of economic benefits and WWF estimates that forests directly generate USD 150 trillion per year, when carbon sequestration potential is included.(4)

“Forests directly generate $150 trillion per year

when carbon sequestration potential is included.”

– WWF Forest Pathways Report 2023

Unfortunately, forest finance has fallen short of these estimates and are not in line with reaching the UNFCCC and UN Biodiversity 2030 objectives:

- International pledges: to protect, conserve, and restore forests (“green” finance) from 2021-25 amount to just USD 29 billion, averaging less than USD 6 billion per year.(5)

- Public finance: for activities with the potential to drive deforestation or forest degradation (“gray” finance) are much larger in magnitude. From 2013-18, gray public finance flows were estimated to range between USD 378 to USD 635 billion per year, globally.(6)

- Deforestation Private Capital: Global Canopy in 2022 found that private financial institutions were providing USD 6.1 trillion in active financing to companies most exposed to deforestation risk in their supply chains.(7)

- Zero Commitments by Banks: 0% of banks are committed to phasing out all financing for coal activities in line with 1.5°C warming.(8)

In September 2024, Forest Declaration Assessment wrote a report entitled Emerging Forest Finance Instruments exploring all mechanisms financing forests, where it identified that in the last few years, a plethora of new public and private initiatives have emerged with the potential to contribute to the goal of ending and reversing forest loss by 2030, as set out in the Glasgow Leaders’ Declaration on Forests and Land Use.(9)

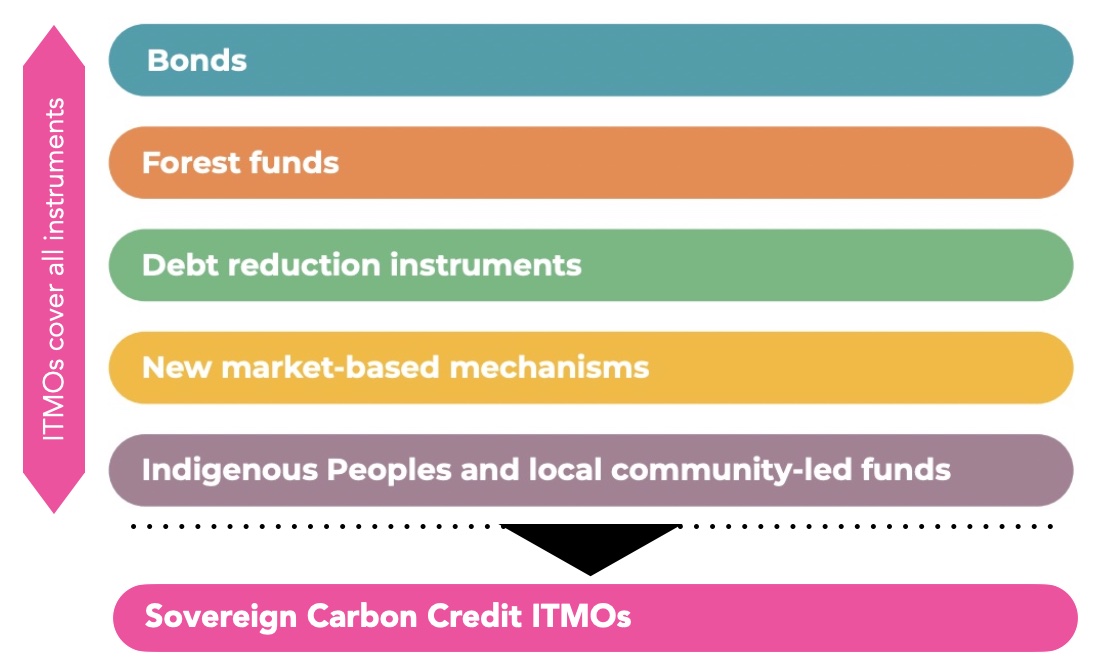

However, the “Sovereign Carbon Credit ITMOs” model was not included, probably because of its recent Suriname’s ITMOs public launch in August 2024.(1) So we included it in pink in their graphics to explain that ITMOs cover all the current financial instruments identified, from Green Bonds to Indigenous Peoples Funds. For the purpose of this paper, we will focus solely on Sovereign Carbon Credit ITMOs, not Sovereign ITMOs Green Bond format, which we will delve into a future report.(10)

ITMOs-Financing-Forest-Goals-2030

ITMOs-Financing-Forest-Goals-2030

Graph 1: Financing Forest Goals 2030 Source: Forest Declaration Assessment

What are ITMOs?

ITMOs (Internationally Transferred Mitigation Outcomes) are a new globally-compliant sovereign asset class (carbon credit) that are issued by a country under the global compliance of the UNFCCC Paris Agreement-Article 6 to incentivise both, country and all 196 parties to reach their respective national and global net-zero targets by 2030 and 2050.(11)

How do ITMOs fit Emerging Forest Finance Instruments?

ITMOs can be used by all of the emerging finance mechanisms pointed out by the Emerging Forest Finance Instruments report. Here we are using as a reference the recent ITMO issuance by Suriname:

- Bonds: BancTrust is currently issuing an ITMOs Green Bond format.(1)

- Forest Funds: ITMOs revenues are directed towards protecting forests.

- Debt Reduction: Part of ITMOs are directed towards the national debt reduction of Suriname

- New Market-Based Mechanism: ITMOs are a new market-based mechanism under the Paris Agreement

- Indigenous Peoples and Community-led Funds: Part of the ITMOs revenues have to go to the Indigenous Peoples.

Graph 2: Different Emerging Forest Financial Instruments Source: Forest Declaration Assessment

How ITMOs address Emerging Forest Finance Objectives

The Emerging Forest Finance Instruments Report correctly indicates that “To achieve the Forest goals, countries that rely on the extraction and consumption of natural resources must be replaced by a fiscal and regulatory environment that mandates and incentivizes the protection, restoration, and the equitable and just management of forests and ecosystems.”(p.34) This is exactly what ITMOs do, when a country fulfils its national and international processes to issue ITMOs.(12)

Furthermore the ITMOs emerging financial instrument presented has the potential to contribute to all the objectives addressed by the Emerging Forest Finance Instruments and offer the following new economic opportunities:

- Account for the economic value of intact forests.

- >> ITMOs account for every single tree in the country under Article 5 of the Paris Agreement.(13)

- Incentivize private sector investment into activities that restore and maintain healthy forests

- >> ITMOs can be sold or invested in by the private sector and the capital markets under Article 6 of the Paris Agreement.(11)

- Deliver finance to high-impact activities, such as the protection and sustainable management of high-integrity forests

- >> ITMOs deliver money directly to high-impact activities nationally through the UNFCCC REDD+ mechanism.(14)

- Enable the most effective forest guardians – Indigenous Peoples and local communities (IP and LCs) – to independently determine how to fund and manage their forest ecosystems

- >> ITMOs contribute to the Local Communities (LCs) and Indigenous Peoples (IPs) through the Cancun Safeguards.(14)

- Meet the triple objective of sustainable development, conservation, and restoration of biodiversity and carbon sinks.

- >> ITMOs contribute to the Sustainable Development Goals (SDGs) and Biodiversity Goals through the Cancun Safeguards. (14)

- Disincentivize activities that act as drivers of deforestation or other unsustainable activities

- >> ITMOs By financing ITMOs a country finances the opportunity cost of cutting down trees from other activities such as mining, forestry, livestock or intensive monoculture agriculture (e.g. Soya beans or Palm Oil).

Key Challenges Addressed by ITMOs for More Natural Capital

In its Future of Nature and Business 2024 report, the World Economic Forum highlighted five key challenges that need to be addressed in order to support greater investment in natural capital. A country’s Sovereign ITMOs address 4 out of the 5 challenges in the following ways:

1. Improved MRV: accessibility, relevance and affordability of technological advances in nature monitoring, and embedding these deeper in decision-making.

• ITMOs solution: Under Article 5 the MRV system is done at national level, not project level and is accessible, and relevant nationally. This MRV system can be replicated to other countries more effectively and affordably. (Please see Graph 2)

2. Transparency: Development of sophisticated capital markets infrastructure to ensure transparency, accountability and the efficient flow of capital to nature-positive projects.

• ITMOs solution: Under Article 13 transparency, accountability and efficient flow of capital is already engrained in the Paris Agreement. This is done at national level not project level, therefore offers scalability to investors.(17)

3. Improved Valuation & Pricing: Improving valuation and pricing of natural capital, so that natural capital investments can compete with traditional business models, driven by better technologies, supportive policies and strengthened collaboration.

• ITMOs (ongoing): As part of the Suriname ITMOs syndication process, current valuation and pricing of being undertaken. Early market signals indicate that ITMOs are being valued at the high-end of carbon credit valuation and pricing, with estimates of $50bn by 2030.(4)

4. Impact & Returns: More patient and catalytic capital that aligns with the speed of nature, allowing for both impacts and returns to be achieved over a longer time horizon.

• ITMOs solution: As ITMOs are backward looking, the impact and returns are already known and are adapted on nature’s (biodiversity and forests) annual growth. This impact and results can be extrapolated into the future. Please see Suriname’s ITMOs registry for further ITMOs.(18)

5. Inclusion of Local Peoples: living and depending on nature – as active participants and decision makers in projects, businesses and initiatives, and appropriate and fair benefit-sharing and governance mechanisms.

• ITMOs solution: As part of the Safeguards System (Step 3 in Graphic 2) Local and Indigenous Rights need to be respected before issuing ITMOs. Furthermore, ITMO-issuing countries such as Suriname must include a fair benefit-sharing scheme with Local and Indigenous Peoples. (19)

Emerging Forest Finance Challenges that ITMOs solve

The Emerging Forest Finance Instruments Report also identified 6 Principles for forest financing and Achieving the 2030 forest goals. ITMOs addresses all these principles:

- Align fiscal policies and incentives with forest and sustainable development goals.

>> ITMOs: When a country issues ITMOs, it needs to respect all of its SDGs.(14) - Ramp up forest financing from industrialized to developing countries that is accessible, affordable, and long-term.

>> ITMOs: Most of the demand for carbon reduction and removal credits will come from industrialised countries such as the EU’s demand to deliver the European Green Deal.(15) - Attract new and additional private finance by lowering risks of conservation with blended finance instruments.

>> ITMOs: ITMOs carry very little risk as the carbon impact has happened already. In addition, ITMOs issuance has to go through two thorough globally compliant verification process, Article 5.2 and Article 6.2 of the Paris Agreement.(12) - Prioritize building capacities and channeling funds to mechanisms that are directly funding local actors, especially IPs and LCs.

>> ITMOs: ITMOs include IPs and LCs when they are issued under the UNFCCC Cancun Safeguards.(14) - Reform sovereign debt to create fiscal space for conservation.

>>ITMOs: ITMOs can be used to serve foreign debt by the issuing government. In fact the current issuance of the world’s first ITMOs by Suriname does exactly that. (Please ask for reference document) - Link financial instruments to emerging measures to reduce the import of deforestation-linked commodities >>ITMOs: under Article 5.2, the UNFCCC REDD+ mechanism is a tool to stop deforestation. Therefore an investor, commodity house or corporation that buys ITMOs are guaranteed that they are not linked to deforestation.(13)

In Conclusion

There are many Forest Finance instruments and Forest Declaration Assessment has done a great job at identifying most of these financial options for investors in their Emerging Forest Finance Instruments report. But to be able to do it at scale requires a solution that is flexible in its financial formats and fulfils global compliance of existing inetrnational agreements such as the UNFCCC Paris Agreement and the UN Convention on Biological Diversity (CBD) goals. This report showcased how investors, corporations and governments can do so by using globally-compliant Sovereign ITMOs, which was, unfortunately, not included in their report, but does fulfil both international agreements.

ITMOs (Internationally Transferred Mitigation Outcomes) are a new globally-compliant sovereign asset class (carbon credit) that are issued by a country under the global compliance of the UNFCCC Paris Agreement-Article 6 to incentivise both, country and all 196 parties to reach their respective national and global net-zero targets by 2030 and 2050.

In addition to providing a globally compliant institutional asset class at scale, ITMOs address all the economic opportunities identified in the Emerging Forest Finance Instruments report, and the 6 Principles for forest financing and achieving the 2030 forest goals. We invite you to be explore ITMOs in more details and scale ITMOs globally. Please ask us to have access to our Virtual Data Room.

-END-

Disclaimer: This material is provided to you by ITMO Limited solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or commitment or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal.

Key Insights

- $150tn

Value of Forest Services including carbon sequestration - 0%

Percentage of banks committed to ending all activities that finance deforestation by 2025 - $50bn

Global Market Value of ITMOs by 2030

Scaling Forest Finance with ITMOs

References

- ITMO Ltd – ITMO Ltd and BancTrust Investment Bank Limited Announce the Offering of the World’s First Sovereign Carbon Credits from the Republic of Suriname under Article 6 of the Paris Agreement https://www.itmo.com/wp-content/uploads/2024/08/ITMO-BancTrust-Suriname-Press-Release-August-23_2024.pdf

- UNFCCC Paris Agreement – https://unfccc.int/process-and-meetings/the-paris-agreement

- UN Convention on Biological Diversity Goals – https://www.cbd.int/article/cop15-cbd-press-release-final-19dec2022

- WWF (2023). The Forest Pathways Report. Gagen, M.H., Dudley, N., Jennings, S., Timmins, H.L. Baldwin Cantello, W., D’Arcy, L., Dodsworth, J.E., Fleming, D., Kleymann, H., Pacheco, P., Price, F., (Lead Authors). WWF, Gland, Switzerland. https://files.worldwildlife.org/wwfcmsprod/files/Publication/file/7nxri5veo8_WWF_Forest_Pathways_Report_2023_ Web.pdf

- Forest Declaration Assessment & Systems Change Lab (2023). Glasgow Leaders’ Declaration Dashboard, Article 5. https://dashboard.forestdeclaration.org/increase-effective-accessible-finance-for-forests-and-land/

- Forest Declaration Assessment Partners. (2023). Off track and falling behind: Tracking progress on 2030 forest goals. Climate Focus (coordinator and editor). https://forestdeclaration.org/resources/forest-declaration-assessment-2023/

- Global Canopy (2023). 2023: A watershed year for action on deforestation: Annual Report 2023. Oxford, England: Global Canopy. https:// forest500.org/publications/2023-watershed-year-action-deforestation/

- Transition Pathway Initiative – State of Transition in the Banking Sector report 2024 https://www.transitionpathwayinitiative.org/publications/89/show_news_article

- UN Climate Change Conference UK 2021 (2021). Glasgow Leaders’ Declaration on Forests and Land Use. https://ukcop26.org/glasgow-leaders-declaration-onforests-and-land-use/

- Forest Declaration Assessment Report 2024 – https://forestdeclaration.org/resources/emerging-forest-finance-instruments/

- UNFCCC Paris Agreement – Article 6 https://unfccc.int/process/the-paris-agreement/cooperative-implementation

- Ministry of Economic Affairs and Climate Action-Carbon Mechanism Review-VOL. 12 | NO. 3 AUTUMN 2024-How Article 6 brings Article 5.2 REDD+ to Global Carbon Markets https://www.carbon-mechanisms.de/en/publications/details/cmr-03-2024

- UNFCCC Paris Agreement – Article 5 – https://unfccc.int/process-and-meetings/the-paris-agreement

- UNFCCC Cancun Safeguards – https://redd.unfccc.int/fact-sheets/safeguards.html

- EU European Commission – Delivering the European Green Deal – https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal/delivering-european-green-deal_en

Keyterms #

#Article6, #ParisAgreement, #EU, #Forest, #ITMOs, #ForestFinance, #ClimateFinance, #CarbonCredit